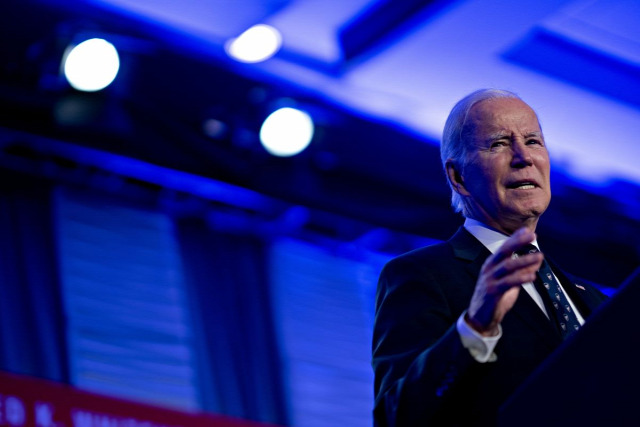

A US presidential veto of congressional legislation is a big moment. Joe Biden is expected to issue the first veto of his presidency to preserve a White House rule allowing fiduciaries of private companies’ pension funds to include environment, social and governance considerations in their investment decisions. Cue brickbats from opponents of ESG over Biden supposedly imposing “woke capitalism”. But the rule only permits, but does not compel, managers to take ESG into account — and the president is defending sound investment principles.

The battle over the investment rule is emblematic of a broader backlash against ESG investing. Republicans and other opponents charge that applying ESG principles may put retirement savings on a sub-par footing. They say fiduciaries could use investments to promote a liberal agenda. Joe Manchin, one of two Democratic senators who sided with Republicans in opposing the White House rule, said it “prioritises politics over getting the best returns”.

The regulation has become a game of ping-pong. The Trump administration in 2020 made it harder for workplace retirement plans to explicitly consider factors such as climate risks. The Biden administration replaced that rule with one easing the way for fiduciaries to consider ESG factors that might affect investment performance. Republican lawmakers used a congressional power of review to strike down the White House rule.

The federal stand-off comes as many Republican-run states are pulling money from big asset managers that have supported sustainable investment policies. Ron DeSantis, the Florida governor, has moved to bar state-run fund managers from taking ESG factors into consideration in investments. In some states, anti-ESG laws have been motivated by claims that asset managers are discriminating against powerful local industries, from oil and gas to coal or firearm makers.

The ESG industry remains flawed. It lacks clearly defined standards of measurement and performance, opening the door to “greenwashing” and other cynical practices. Compelling money managers to be bound by its dictates would be misguided. The White House rule contains no compulsion, however. It merely allows fiduciaries to take ESG considerations into account as part of a prudent strategy. And asset managers increasingly realise that earning the best returns, and avoiding losses, means considering all risks and externalities related to any investment. Company values can be affected by more than just financial performance.

200. CONSPIRACY THEORY

201. COOKING

202. COP

203. CORPSE

204. CORRUPTION

205. COUNTRY MUSIC

206. COUNTRYSIDE

207. COUPLE

208. COURT CASE

209. COURTROOM

210. COWBOY

211. CREATURE

212. CRIMINAL

213. CUBA

214. CULT

215. CULT FILM

216. CULTURE

217. CURSE

218. CYBERPUNK

219. CYBORG

220. CYCLING

221. DANCE

222. DANCER

223. DANCING

224. DARK COMEDY

225. DATING

226. DAUGHTER

227. DC COMICS

228. DEATH

229. DEBT

230. DECAPITATION

231. DECEPTION

232. DEMON

233. DENMARK

234. DEPRESSION

235. DESERT

236. DETECTIVE

237. DEVIL

238. DIAMOND

239. DINOSAUR

240. DISABILITY

241. DISAPPEARANCE

242. DISASTER

243. DISEASE

244. DISGUISE

245. DIVORCE

246. DOCTOR

247. DOCUDRAMA

248. DOCUMENTARY FILMMAKING

249. DOG

250. DOMESTIC VIOLENCE

251. DRAG QUEEN

252. DRAGON

253. DREAM

254. DRUG ABUSE

255. DRUG ADDICTION

256. DRUG DEALER

257. DRUG TRAFFIC

258. DRUG USE

259. DRUGS

260. DUEL

261. DURINGCREDITSSTINGER

262. DUTCH CABARET

263. DYING AND DEATH

264. DYSFUNCTIONAL FAMILY

265. DYSTOPIA

266. EARLY 1900S

267. EARTHQUAKE

268. ECONOMICS

269. EDUCATION

Companies are under pressure from sections of society to adopt climate-friendly policies, pursue positive social goals and promote diversity and inclusion in the workplace. They face constant scrutiny from social media, activists and proxy groups. But there are already safeguards against pension managers using ESG as cover to pursue political agendas. The legislation underlying the new rule explicitly requires fiduciaries to act prudently and in the financial interests of pension plan participants.

A Biden veto will ensure company pension plans can take ESG into account. Republican-run states will still have the right to bar public pension funds from doing so. But they should be wary of how they exercise that power. An Indiana fiscal watchdog last month estimated that, by restricting fund managers’ options, a proposed state law limiting their use of sustainable investment factors could reduce returns of the public pension system by $6.7bn over a decade. Blocking some investment considerations not only amounts to interference in the market of a kind Republicans have long claimed to oppose. It could also result in the opposite of what is intended.